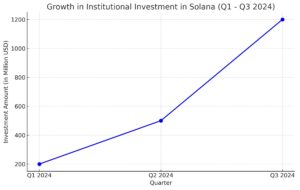

Solana’s increasing institutional interest highlights a significant boost in investment in Solana-based decentralized applications (dApps). In the third quarter of 2024, institutional investments in Solana dApps reached $173 million, marking a substantial 54% increase from the previous quarter. This rise suggests growing confidence among institutional investors in Solana’s technical scalability and expanding ecosystem.

Institutional investors are particularly drawn to Solana’s high transaction speeds and low costs, which make it an attractive platform for building and deploying dApps in areas like finance, gaming, and NFTs. This interest aligns with Solana’s focus on providing a blockchain infrastructure capable of handling high volumes of transactions, appealing to projects that prioritize scalability without compromising on decentralization.

This trend also reflects the increasing traction of Layer-1 blockchains as institutions look for alternatives to Ethereum, which often faces congestion and higher transaction fees. As a result, Solana’s ecosystem has continued to attract both developers and investors, which could further strengthen the blockchain’s position in the market.

Such growth in institutional capital may also provide more resources for development within the Solana network, potentially accelerating adoption and innovation on the platform.

Analyst’s View on the Institutional Growth of Solana

Analysts have noted strong institutional interest in Solana’s ecosystem, with over $173 million invested in Solana-based projects in Q3 2024—a notable 54% increase from the previous quarter. Major companies like Visa, PayPal, and Franklin Templeton expanding on the network probably contributed to this growth.

Matthew Nay, research analyst at Messari, said,

“Those projects in the Solana ecosystem which have weathered the most recent bear market are seeing huge inflows into their companies. Examples include Drift’s $25 million Series B funding and Multicoin’s $12 million into Energy DePIN.”

He added,

“For scalability, strong DeFi capabilities, and the reasons related to the development of the ecosystem, financial giants are coming to Solana”

With the recent launch of Firedancer on mainnet and other upgrades, Solana has been in a better position to upscale its transaction efficiency, hence being more attractive for institutions looking for a scalable and relatively cheap blockchain network. This greater confidence would hint at a bright outlook for Solana’s future as a leading blockchain for decentralized finance and for institutional use cases.

Institutional Interest: Why Now?

Institutional investors see Solana’s combination of scalability, low costs, and an expanding ecosystem as an opportunity to enter a market that is maturing and growing steadily. In Q3 2024 alone, Solana’s $173 million in new institutional investment represents a marked increase in confidence from large financial players. This growth is especially significant because institutional investments often indicate long-term faith in a platform’s viability, making it more than just a short-term trend.

Future Implications for Solana and the Crypto Market

As Solana’s ecosystem grows, it may continue attracting institutional interest, solidifying its place as a leader among blockchain networks. This increase in high-profile investment could also pave the way for more developers and projects to build on Solana, potentially creating a positive feedback loop that strengthens the platform even further.

For investors, Solana’s success in attracting institutional capital suggests a promising outlook for the network’s future, especially as it competes with other popular blockchains like Ethereum and Polygon.

In short, the latest surge in institutional investment reflects a broader trend of interest in Solana’s unique capabilities, hinting at its potential to continue growing as a preferred blockchain platform for scalable and cost-effective dApps.